Are You Robbing Your Piggy Bank on your Rental Property?

Don’t do it…..Picture this for just a minute…You just received a notice from your resident that they are vacating after six years and you know your rental property is going to have some hefty repairs. Then the resident moves out, and either you or your management company does an inspection, and you find out you're facing $8,000 to make the property rent ready for the next resident. Gasp…” You’ve been ROBBED” Panic sets in because you know that your piggy bank (aka your bank account) is EMPTY or close to it. Where did all your money go? Your property has been rented for six years, you’ve been getting moderate increases in rents each year, yet you have no significant money to pay for this unexpected repairs. How can it be that your account is EMPTY?

The answer: YOU ROBBED YOURSELF

That’s right! And now you’re thinking "why do I own this property maybe I should sell it?", don’t do this either, read on...

Let me explain. During the last 30+ years of owning and running a property management company, I have seen this scenario play out hundreds of times. Landlords are caught off guard when it comes to major repairs or even one large repair or improvement after a resident moves out of their home after several years. They are not prepared for these types of repairs. Sometimes even the smaller repairs catch a landlord off guard. The old saying “Save for a rainy day” is true when you own a rental property. For this reason, I started teaching landlords the SECRET….

Keep Reading to find out the SECRET to financing your current or next rental property repairs and improvements…

Table of Contents

Advantages of Owning A Rental Property

Having a rental property has a lot of advantages. Typically, the property is appreciating at a rate of 2-7% a year, depending on the property location. Then there are the tax benefits where on one single-family home you can save up to $2500 on your income taxes every year. Having the ability to write off the interest on the loan, insurance, home repairs, and property management fees is a plus. Almost every operating cost is a write-off. The loan on the property, the principal is reducing every month from $200-$500 just from the rent the resident is paying. Eventually, over the next fifteen to thirty years, the resident helps pays off the loan on the property for you. Once your property is paid off, you have a steady stream of cash flow every month, paid to you, for the rest of your life. Sounds great right? While these are all great reasons to invest in a rental property, I was once told by my real estate mentor, many years ago, that you can’t pay the repair bills with any of the above.

Downsides to Owning A Rental Property

Two of the downsides of rental property ownership are maintenance/repairs and vacancies. We all know things will eventually wear out, but sometimes we’re not prepared for it. Especially when those items are of the high-ticket variety like painting, flooring, appliances, air conditioner, and even blinds when a resident moves out can create a financial hardship. These things can add up to a few thousand dollars very quickly. Even the small things, like a $100 faucet repair or a dishwasher replacement at $400 a pop, can dig into your personal checking account.

Money that you may have had other plans for, right? Sometimes I’ve seen owners not

take a pre-planned vacation with the kids simply because when a renter moved out and repair bills came in, they couldn’t afford to do so and that truly saddens me. A $10,000 bill to repair or replace a leaky roof shouldn’t be a tragedy that prevents a family vacation. It doesn’t have to be that way!

Believe it or not, I have the answer. What I am about to share, I practice for the properties that I own. I even use other management companies to manage my properties in other states where I own property. So, you can say, I sit where you sit. I understand well the trials and tribulations of repairs and maintenance expenses, and just like you, I must be prepared financially for when they come up, just like you.

Avoid Being Surprised

So here are a few simple ways I recommend that will help you avoid being surprised, or even blindsided by repairs and maintenance of your rental property. Let’s start by explaining what not to do. What typically happens when a new real estate investor purchases a rental property is, they use a personal checking account. We will call this “Option A.” In this scenario, when there is a repair, the management company will either deduct it from the rent or ask you to send in a check to cover the cost of the repair. Then as the rent comes in, the management company will electronically deposit the rent into your personal checking account or mail you a check to deposit. Also, as the management company raises the rents on your property, that additional money keeps going into that personal checking account. Guess what happens?

You have more monies coming in, but it just gets eaten up in that checking account for personal things, like groceries, family vacations, braces for the kids, a day at Disneyland, etc. Everyday life purchases and bills come out, and that is where the challenge begins. With Option A., your money becomes commingled with your personal checking account and life. Over the years, you can’t figure out what is personal and what is investment anymore.

It is then you begin to feel like you will always be robbing your personal checking account to pay for repairs on your rental property. Over time that starts to wear on you, and you begin to wonder why you have the rental property in the first place, right? How would I know this?

Because I’ve lived it. The appreciation rate in which your property value is going up isn’t seen

because you can’t use that money right now. Then the tax write-offs are not seen as much of a benefit anymore because the write-offs are now entangled in your other personal expenses and taxes.

That is when we begin to forget about all those savings on taxes. Also, even though the resident is paying down your loan each month, even a couple of hundred dollars is like watching grass grow, so, unfortunately, our focus is only on one thing. That’s right, taking money out of your personal checking account to pay for repairs on your rental property. Again.

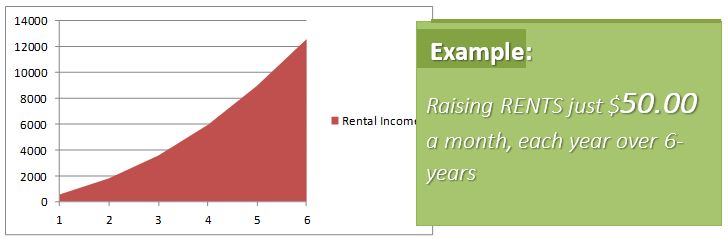

Now let’s talk about Option B. There is a simple fix to this, and here it is. In option B, you open and set up a separate checking or checking savings account and name it “Checking investment rental account.” (If you have multiple properties you can combine them all in one account) I recommend you deposit a minimum of $1000-$5000 from your personal savings account to your new “checking investment rental account.” If you must start with less, do it anyway because it’s essential you begin immediately. Next, pay your mortgage or mortgages, taxes, insurance, and repairs from this account. Second, deposit or contact your management company, if you use one, to electronically deposit your rent into this new account. Here is the secret in why it works. As rents increase, almost every year, that extra rent will start to build this new account. Let me give an example. When the rent increases just $50 a month each year for 6 years (which is only 2.9% rise in rent on average) and deposited into your checking account, in 6 years you will have $12,600 and if the rent increases a $100 a month you will see $25,200 in your new checking investment rental account after 6 years. You will now be the money because you’re not using it for things in your daily life. See the diagram below. It’s just like compounding interest.

Maintenance and Repairs

You can’t have a rental property without repairs. We know that and if you use Option B not only will you have the money to pay for repairs, you’ll have enough for the large ones. In 5-7 years, you might have $10-20,000 in additional income to re-paint the exterior of the home, replace the flooring or buy a new appliance, etc. You’ll want to make improvements on your property to make sure it’s in good shape because one day, it will be paying you, as mine are paying me today.

I have several properties today that I own free and clear. They are paying me today every single month and what a great feeling it is. Not to mention the properties are worth, on average, 5-7 times what I paid for them 15 and 30 years ago. Plus, I still write off my repairs, taxes, insurance, etc. on my taxes, offsetting the rental income I get each month. Using this strategy allows you to enjoy the journey while you build towards your retirement. You will find yourself buying more properties because now it’s exciting and paying for repairs becomes painless.

End of Year Assessment

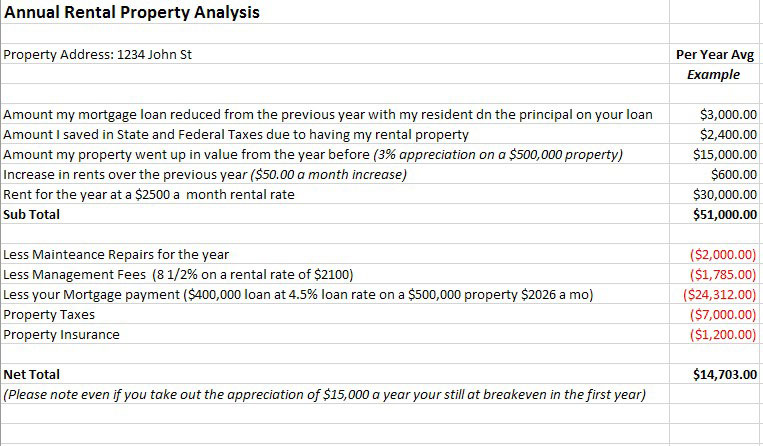

Lastly, I encourage you, once a year, to do one more thing. Ask your CPA or person doing your taxes, how much you saved on your income taxes on FEDERAL and STATE and write that down. Also, look at how much your mortgage has reduced from the year before and write that down. Also, your Real Estate Agent can tell you how much your property increased in value in the last 12 months. Write down how much you made in increased rents during the previous year and then total all the columns. Taking one hour a year to do this will give you a whole different perspective on your rental property. See the diagram below that you can use.

Real Life

Recently, I received a call from one of my clients, who I started doing business with back in 1977, 42 years ago, in Riverside, California. Believe it or not, I met them knocking doors. They bought a home for $35,000. Gene and Betty now live in Georgia, and they were just reviewing their financials while doing their taxes. Gene said he just wanted to call me to say, “thank you.” He said, “they are now worth over 1.7 million dollars primarily due to you Ron on all the investments we’ve done with you. We are set for life with all the income they have coming in and are traveling and enjoying life.” Gene and Betty are just great regular ordinary people, not big investors, who started small and ended up big. Gene went on to say “all those people who didn’t believe in you and your strategy way back 43b3ff8c70ethen Ron, are not having the life we have today, and that’s sad. I wish more people would have followed your strategy.

In closing, I wish this all for each of you in that you too will end up big like Gene and Betty. There is still time to get started; it doesn’t matter if you recently purchased a rental property or have owned your investment for 20 years, Start TODAY with Option B!